If you (or your child) are a junior or senior in high school, and you are still not sure what you would like to do after you (or your child) graduates high school, then you might want to consider pausing and weighing your options.

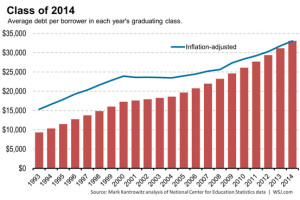

If you (or your child) is a “Millennial” (a young adult born between the years 1982 – 2004), then you are not only going to be considered a member of one of the most educated generations, but also one of the most indebted. Student loan debt has tripled since 1990, while earnings and jobs have stagnated for most college graduates.

According to a report from the Institute for College Access and Success, the average amount of student loan debt for the Class of 2013 was approaching $30,000 compared to just under $10,000 in 1993.

And to make matters even worse, over 8% of today’s college graduates are unemployed. Before the Great Recession of 2008 hit, only 6% of recent college graduates were unemployed. Back during the last year of the Clinton administration in 2000, this number was just 4 percent.

So why do I advocate Self-Economics over College? Because The U.S. Treasury Department and the Department of Education teamed up from 2010 to 2012 to assess financial literacy in U.S. high schools, and the results weren’t pretty: the average financial literacy score of almost 76,900 students in 2010 was 70 percent. 2011’s testing of about 84,000 students and 2012’s of about 80,000 students were both a point lower: 69 percent. Though Americans have struggled for decades with financial illiteracy, state curricula has not shifted much to address these educational gaps.

In fact, fewer than half of the states make high school students take economics classes, and just 13 require a personal finance class, according to a 2011 survey by the Council for Economic Education. The biennial survey also shows that just 16 states require testing in economics, three fewer than in 2009. This regression is noted in the survey summary, which points out that over the past several years, the trend toward teaching these subjects has slowed, and is “in some cases moving backwards.”

Yet despite all of the ongoing research and statistics, little effort or action has been taken by Washington and the nation’s Department of Education or the state Boards of Education across the country toward changing or addressing the way schools should be educating children to properly prepare them for the new financial and societal challenges that have been created by economic and social changes.

It should come as no surprise that like most middle-aged adults today, young and emerging adults who are now graduating college are also finding it hard to find work in the marketplace after graduation. Even worse, most are not prepared and feel ill-equipped to become financially independent, since the majority of their parents and teachers lacked the knowledge required to impart this crucial financial information to these Millennials.

In my book, Demystifying Success: Success Tools and Secrets They Don’t Teach You in High School, I have chosen to proactively educate today’s emerging adults to avoid the very financial pitfalls that are currently paralyzing and plaguing so many older adults. These young adults must be educated now with the appropriate information, tools and resources so they no longer follow blindly in the footsteps of the generations before them and perpetuate the continuing cycle of financial illiteracy in the United States. We must encourage them instead to develop new and self-reliant ways to succeed on their own terms. Moreover, we can positively impact their future personal and financial success by empowering emerging adults during their early, formative years to begin to think entrepreneurially and independently toward make better financial decisions earlier in their lives.

In the April, 24, 2012 USA Today article by Hadley Malcolm, “The Cost of Financial Illiteracy”, Annamaria Lusardi, an economics and accountancy professor and director of the financial literacy center at George Washington University, said, “If we live in a world where people are in charge of their own financial well-being … we have to equip people to deal with this individual responsibility.”

“Only about two-thirds (more than 2,000) of the total college and universities in the United States now offer a course in entrepreneurship. A smaller but growing number have entire sequences leading to an undergraduate minor, a master’s in entrepreneurship, or something similar,” said Judith Cone, Vice President of Entrepreneurship, Ewing Marion Kauffman Foundation.

It’s time to face the facts, most colleges and universities are no longer in any position to guarantee its students full-time employment in their chosen fields of study upon graduation anywhere near the amount of money they will need to pay off in educational debt. With that being said, doesn’t it make much more sense for you (or your child) to simple consider applying to a local community college as an “undecided” (or “undeclared”) major to avoid hefty tuition costs, or pursue a dream job or career before finding yourself forced to take on a “whatever job” in order to pay back exorbitant student loans?

It’s time we all woke up and start embracing “Self-Economics”. We must begin educating ourselves in the areas of financial literacy (personal finance and investing), personal development (a more theoretical approach [“the power of why”] to strategic and not emotional decision making), and entrepreneurship (which encompasses many of the elements of my T.I.M.E. Model) so we can all effectively compete in this new era of global uncertainty.

Maybe a better question is, what will happen if you don’t?